Salary Advances and Overdrafts in Ghana

In today’s dynamic economic landscape, unexpected financial needs can arise at any moment. For salaried workers in Ghana, salary advances and overdraft facilities offered by banks can provide a crucial lifeline to bridge the gap between paychecks. This blog post delves into the concept of salary advances and overdrafts, explores the offerings of various financial institutions in Ghana, examines their effectiveness, and highlights key requirements.

FOLLOW PUBLIC SECTOR WORKERS UPDATES HERE

CONTACT SEEKERS CONSULT 247 FOR THESE SERVICES

0550414552

LOANS

TRANSCRIPT

ENGLISH PROFICIENCY

ACADEMIC REFERENCE

Understanding Salary Advance and Overdraft Facilities:

A salary advance is essentially a short-term loan or an overdraft facility granted by a financial institution to a salaried employee against their next salary payment. It’s designed to address urgent financial needs that may arise before payday.

An overdraft is a credit facility that allows account holders to withdraw an amount exceeding their available balance, up to a pre-approved limit. In the context of salary earners, this limit is often tied to their salary.

Both salary advances and overdrafts aim to provide quick access to funds for immediate needs.

Financial Institutions Offering Salary Advances/Overdrafts in Ghana:

Several banks in Ghana offer salary advance or overdraft facilities to their customers. Here’s a look at some of them and their specific offerings:

1. Stanbic Bank:

- Product Name: Stanbic Salary Advance

- Overview: A personal overdraft tailored for salaried individuals to meet short-term cash flow needs.

- Key Features:

- Minimum monthly income: GHS 500

- Minimum overdraft limit: GHS 100

- Access Anytime: Funds available whenever needed within the limit.

- Convenience: Monthly repayment of the used limit or a 30-day clean-up cycle.

- Pay as you go: Interest charged only on the amount used.

- No Fuss: Full settlement upon salary payment, avoiding fixed monthly repayments.

- Advance of up to 50% of disposable net monthly salary.

- Facility limit renewal subject to satisfactory account performance.

- Facility fee: 2% (minimum GHS 50) on approved limit and at each renewal.

- Credit Life insurance premium: 1% on approved limit against death and permanent disability.

- Interest applies only on the utilized portion of the overdraft.

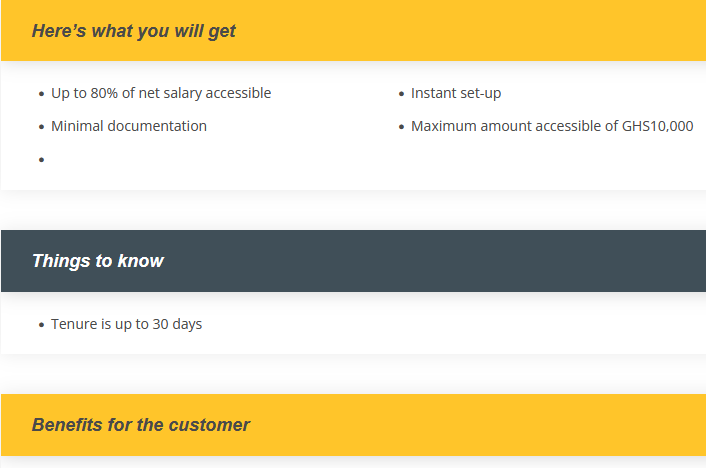

2. GCB Bank:

- Product Name: Salary Advance (Overdraft facility)

- Target Market: Salaried workers with GCB accounts and Pensioners with GCB accounts.

- Key Features:

- Up to 80% of net salary accessible.

- Instant set-up.

- Minimal documentation.

- Maximum accessible amount: GHS 10,000.

- Tenure: Up to 30 days.

- Interest paid only on the amount utilized.

- Available to reapply after repayment.

- Requirements:

- Completed Loan (salary advance) application form.

- Ecowas Identity Card (Ghana Card).

3. Access Bank:

- Product Name: Salary Advance (part of a bouquet of loans for salary account holders)

- Key Features:

- 24/7 service via QuickBucks App or USSD code (*901*11*1#).

- No documentation required.

- No collateral required.

- Six (6) months tenor for other loans, specific tenor for salary advance not explicitly stated but implied to be short-term.

- 10% interest rate reduction on other loans for salary account holders.

4. Agricultural Development Bank (ADB):

- Product Name: Salary Overdraft

- Key Features:

- Overdraft limit: GHS 100 to GHS 20,000.

- Eligibility: Registered salaried worker of an appraised institution with continuous salary for 6 months prior. Must not be defaulting on other loans.

- Minimum salary: GHS 500.

- Tenure: 30 days to 12 months.

- Interest rate: ADB base rate + 9% per annum.

- Overdraft arrangement fee: 1% of the amount.

- Insurance cover: 1% of Overdraft Limit (prior to setting the limit).

- Requirements:

- KYC Documentation for new-to-bank customers.

- Completed application form from the branch.

FOLLOW PUBLIC SECTOR WORKERS UPDATES HERE

5. In-Company/Institutional Salary Advances:

Some organizations offer salary advances directly to their employees, bypassing traditional banking procedures.

- Process: Employees typically submit a request to the HR department, who then directs it to the Accountant for payment. This process can often be completed within a day or two.

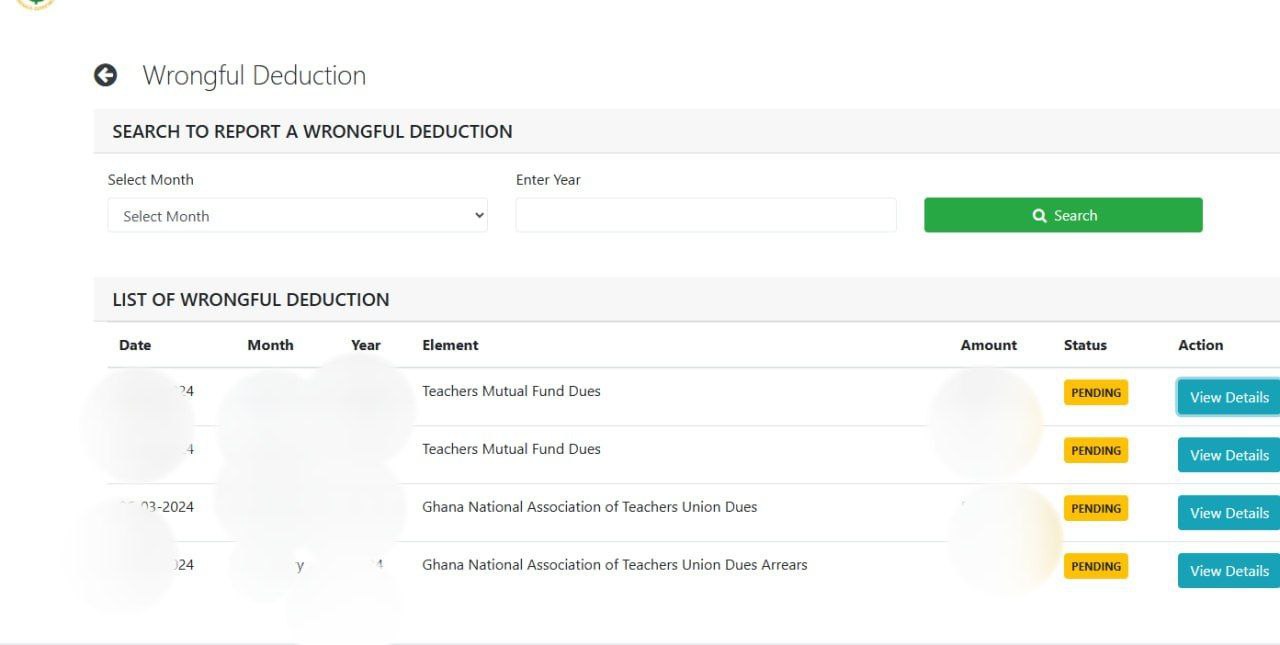

6. Ghana Education Service (GES) Salary Advance Loan:

- Target Group: GES Teachers

- Key Features (as per provided information):

- Interest-free.

- Loan amount: Up to 150% of annual gross salary.

- Repayment period: 84 months (7 years) with equal installments.

- Application Process (as per provided information):

- Application letter from the teacher.

- Cover letter from the head of the school/institution.

- Submission to the IPPD (Institute of Personnel Management and Development) coordinator.

- Challenges: Delays and lack of clear communication regarding the status of applications have been reported.

7. Rural Banks:

Many rural banks in Ghana also offer salary advance facilities. Requirements may vary, and it is advisable to contact your specific rural bank branch for detailed information.

Effectiveness of Salary Advances and Overdrafts:

Salary advances and overdrafts can be effective tools for managing short-term financial needs. Their key benefits include:

- Quick Access to Funds: They provide immediate access to cash for emergencies or urgent expenses.

- Convenience: Application processes are often relatively straightforward, especially for existing account holders.

- Flexibility: Overdrafts allow you to borrow only the amount you need, and interest is usually charged only on the utilized portion.

- Avoiding High-Interest Alternatives: They can be a more cost-effective alternative to payday loans or other high-interest borrowing options.

However, it’s crucial to use these facilities responsibly:

- Interest Costs: While convenient, interest charges and fees can accumulate if the borrowed amount is not repaid promptly.

- Debt Cycle: Relying too frequently on salary advances can create a cycle of debt, where a significant portion of each salary goes towards repaying the previous advance.

- Eligibility Criteria: Not all salaried workers may qualify, and eligibility criteria vary between institutions.

Key Requirements to Note:

While specific requirements may differ between banks, common prerequisites for accessing salary advances or overdrafts often include:

- Proof of Employment: Letter of employment or staff ID.

- Salary Account: Having an active salary account with the lending institution for a specified period.

- Minimum Income: Meeting a minimum monthly salary threshold.

- Identification: Valid national identification (e.g., Ghana Card, Ecowas ID).

- Application Form: Completing the bank’s salary advance/overdraft application form.

- Creditworthiness: A satisfactory credit history (in some cases).

- For GES Teachers: Application letter and cover letter from the head of the institution.

Salary advances and overdraft facilities offered by banks and other institutions in Ghana can be valuable resources for managing short-term financial needs.

Understanding the offerings, requirements, and associated costs of different institutions is essential for making informed decisions. While they provide convenience and quick access to funds, responsible usage and timely repayment are crucial to avoid unnecessary financial burdens.

Exploring options from various banks and even your own workplace can help you find the most suitable solution for your individual circumstances.

Remember to always inquire about the specific terms and conditions before committing to any salary advance or overdraft facility.

FOLLOW PUBLIC SECTOR WORKERS UPDATES HERE