Are You Seeing Affordability Issues on Your ePayslip Portal? Here’s What You Need to Know

Noticed a zero, negative, or unusually low affordability margin on your ePayslip portal? Don’t panic! Here’s a breakdown of what affordability means, why discrepancies happen, and how to resolve them.

Join Us for the Latest on our WhatsApp Channel. Click Here

What’s New?

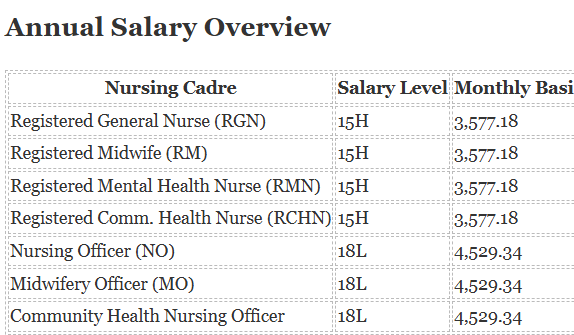

The Controller and Accountant General’s Department (CAGD), in collaboration with the Government of Ghana (GoG) payroll managers, has implemented an increase in the affordability margin for the May 2025 payslip.

This adjustment affects loan approvals, pending transactions, and salary deductions. If you’re planning to apply for a loan or have pending salary-related requests, this update is crucial for you.

Key Changes & How They Affect You

1. Loan Applications May Be Rejected

-

If you have a pending loan awaiting disbursement, the new 20 deduction limit could impact approval.

-

Loans that exceed the revised affordability margin will be automatically rejected.

-

Example: If your previous affordability margin was 10 the system now checks against the updated threshold.

2. Pending Transactions Could Be Delayed

-

Any salary-related transactions (advances, deductions, etc.) that exceed the new margin will remain pending.

-

Action Required: Confirm your updated affordability margin before submitting requests to avoid delays.

The New Affordability Margin is 30

What Is Affordability?

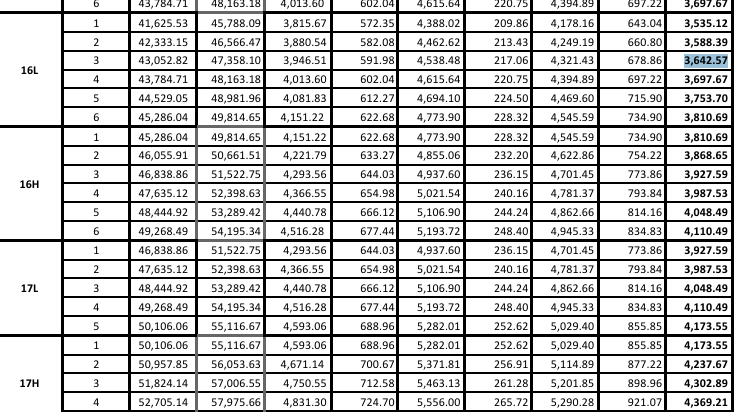

Your affordability is the maximum amount available for deductions like loans, insurance premiums, union dues, or mutual funds. Importantly, statutory deductions (e.g., taxes, social security) are not part of this limit.

Example: If your affordability shows GHS 1,500, your total deductions cannot exceed this amount in a given month.

Understanding Affordability Margin

The affordability margin (usually around 10) is the buffer between your actual affordability and available deductions. Some employees may see a higher margin (e.g., 50), depending on their payroll deductions issues at a given time.

Contact

Seekers Consult 247

0550414552

for your Loans,

Your Academic Transcript and English Proficiency

Evaluation to WES, SPANTRAN, CES, CGFNS, NACE, QECO, etc

Why Does Affordability Drop to Zero or Negative?

Several factors can cause discrepancies:

-

Excessive Deductions

-

Multiple insurance policies or union dues increasing over time.

-

Loans with rising repayment amounts.

-

If combined deductions exceed your affordability, it may show zero or negative.

-

-

If you opt for two insurance policies, each might deduct GHS 20 per month initially, then increase to GHS 25 the following year.

-

Unions may also raise their dues over time.

Since these deductions rely on your affordability, failing to accommodate the increases can push your affordability into zero or even negative values.

-

Controller & Accountant General’s Department (CAGD) System Updates

-

Delays in updating new salary increments can temporarily freeze or reset affordability.

-

-

Unauthorized Bank Deductions

-

Some banks deduct loan amounts without consent (because your salary account is with them) and refund later. This can temporarily reduce affordability even if you didn’t take a loan.

-

-

Processing Multiple Loans at Once

-

Applying for several loans simultaneously can trigger pending deductions, eating into your affordability before the first loan is fully processed.

-

What to do

What Should You Do?

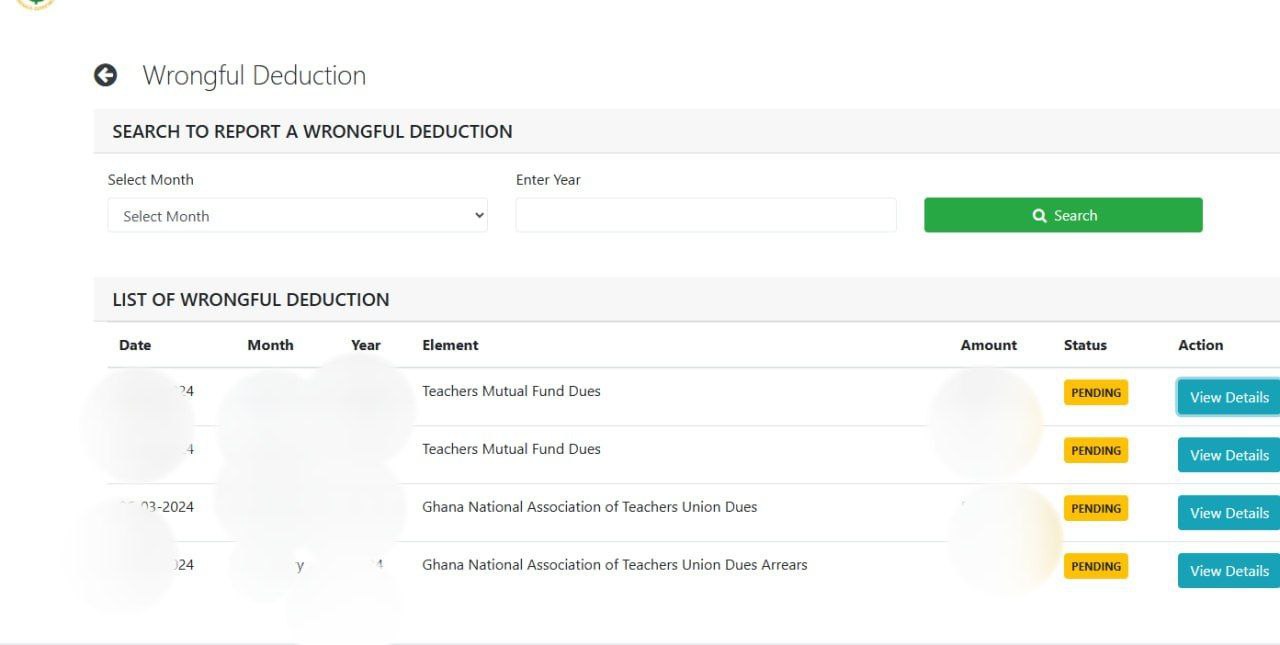

Wait and check your “Wrongful Deductions” section. You may see some pending deductions, which means the system has not yet processed them. Give it time—these will typically resolve automatically.

Avoid multiple loan applications – Process one at a time. Also for those who have not contracted Loans but are being deducted and refunded, go to the bank and make them stop or Report them to Controller for Wrongful Deductions.

Report unauthorized bank deductions : Report Wrongful Deductions on the Payslip Portal Directly and also go to your HR, or the IPPD Coordinator to Report.

Wait for system updates – If CAGD is upgrading, affordability should normalize afterward.

Seekersnewsgh.com

For Your Payroll Loans Contact Seekers Consult 247. 0550414552

Join Us for the Latest on our WhatsApp Channel. Click Here

More Updates Will Come.

Share with Us, What is Your Issue, Do not Share any sensitive information in the Comment Section, it won’t be approved.