GNAT Loan Chart and the Types of Loans Available

Explore the GNAT Loan Chart and the types of Loans Available for 2025, including all new requirements.

There have been new initiatives put in place as many come for the loans and runoffs.

Some include the Guarantor system.

For Salary Loans, Contact Us at Seekers Consult 247

0550414552, Loans for a max Duration of 96 months, thus 8 years.

Basic conditions for loans

GNAT membership

Six (6) months of mutual Fund Contribution

Affordability (i.e. ability to service loan)

Total Contribution ≥ 15% of Loan Amount

Monthly Contribution of 1% (of loan approved) thereafter

Follow Public Sector Workers Click Here

Change in Loan Requirements

NEW

Teachers’ Fund Increases Personal Loan Limit to GHS 40,000 Effective September 2025

The Teachers’ Fund LBG has announced an upward adjustment in the ceiling for its Personal Loan Facility, effective 1st September 2025.

In a circular addressed to all Regional and District Secretaries of the Ghana National Association of Teachers (GNAT), the Fund stated that the maximum amount for personal loans will increase from GHS 35,000 to GHS 40,000.

According to the management, all other loan products will maintain their current limits and terms for now. The revised loan limits are as follows:

| Loan Type | Current Limit | New Limit | Duration |

|---|---|---|---|

| Personal | 35,000 | 40,000 | 48 Months |

| Investment Capital | 50,000 | 50,000 | 60 Months |

| Habitat | 60,000 | 60,000 | 60 Months |

| Vehicle | 70,000 | 70,000 | Up to 84 Months |

Contact Seekers

0550414552

For Your Loans, Reduced rate effective August 2025

Transcript applications ( UCC, UEW, KNUST, UG … and more)

Certificate Evaluations

Affidavit Applications

Gazette

Errands service on Birth Certificate

Passport Application

Scholarships

CV / resume writing

Thesis / article writing

Recommendation letters

Accommodations / Hostel

Statement of purpose ( SOP )

Verified Jobs, Internship, and more

JOIN US FOR MORE UPDATES CLICK HERE

Feb. 2024 Release

Salary, allowance, and affordability Updates you don’t want to miss Follow here

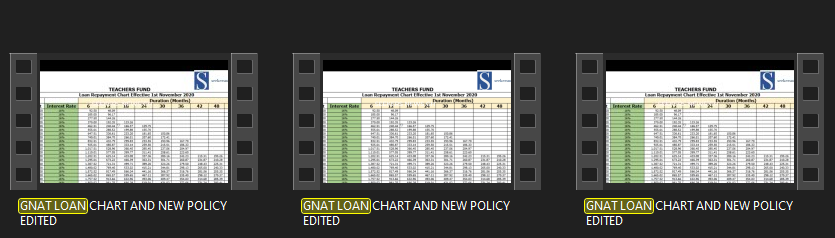

GNAT Loan Interest Rate

Interest rate 16% per annum at reducing balance

How Long it takes for the Teacher Unions(GNAT,NAGRAT, CCT) to Process your Loan Now

Types of GNAT Loans and Amount

Personal Loan

Personal loan up to GHC 35,000 Click to see details.

| DOCUMENTS REQUIRED | QTY | REMARKS |

| Passport Pictures | 2 | Current Passport Pictures |

| Mandate Form | 2 | Current with different mandate numbers |

| Valid National ID | 2 | Acceptable I.Ds are: Voters ID, Driving Licenses, NHIS, Passport and SSNIT Card |

| Payslip | 2 | Two months current payslip eg. March |

| Loan Application Form | 1 | Must be signed by the applicant and Two DFC members |

| Authority Note | 2 | Must be signed by application |

| n Advance Form | 1 | Must be signed by District Secretary and endorsed by G.E.S Director |

Witness and Guarantors:

How to Generate Mandate Form / a mandate Number and pin

How to Check Your Affordability on CAGD Epayslip Portal

Habitat Loan

Habitat loan of up to GHC 60,000.00

| DOCUMENTS REQUIRED | QTY | REMARKS |

| Passport Pictures | 2 | Current Passport Pictures |

| Mandate Form | 2 | Current with different mandate numbers |

| Valid National ID | 2 | Acceptable I.Ds are: Voters ID, Driving Licenses, NHIS, Passport and SSNIT Card |

| Payslip | 2 | Two months current payslip eg. March |

| Loan Application Form | 1 | Must be signed by the applicant and Two DFC members |

| Authority Note | 2 | Must be signed by applicant |

| Loan Advance Form | 1 | Must be signed by District Secretary and endorsed by G.E.S Director |

| Site Plan | 1 | |

| Indenture | 1 |

Witness and Guarantors:

Investment Loan

Investment loan of up to GHC 50,000.00

| DOCUMENTS REQUIRED | QTY | REMARKS |

| Passport Pictures | 2 | Current Passport Pictures |

| Mandate Form | 2 | Current with different mandate numbers |

| Valid National ID | 2 | Acceptable I.Ds are: Voters ID, Driving Licenses, NHIS, Passport and SSNIT Card |

| Payslip | 2 | Two months current payslip eg. March |

| Loan Application Form | 1 | Must be signed by the applicant and Two DFC members |

| Authority Note | 2 | Must be signed by applicant |

| Loan Advance Form | 1 | Must be signed by District Secretary and endorsed by G.E.S Director |

| Certificate of Registration/Certificate of incorporation/Business Proposal | 1 | Must provide any of the following business documents |

| Proforma Invoice | 1 |

Witness and Guarantors:

Vehicle Loan

Vehicle loan of up to GHC 70,000.00

| DOCUMENTS REQUIRED | QTY | REMARKS |

| Passport Pictures | 2 | Current Passport Pictures |

| Mandate Form | 2 | Current with different mandate numbers |

| Valid National ID | 2 | Acceptable I.Ds are: Voters ID, Driving Licenses, NHIS, Passport, and SSNIT Card |

| Payslip | 2 | Two months current payslip eg. March |

| Loan Application Form | 1 | Must be signed by the applicant and Two DFC members |

| Authority Note | 2 | Must be signed by applicant |

| Loan Advance Form | 1 | Must be signed by District Secretary and endorsed by G.E.S Director |

| Proforma Invoice | 1 | Must provide Proforma Invoice of Vehicle |

| Valuation Certificate | 1 | Must provide Valuation Certificate of Vehicle preferably from STC |

Witness and Guarantors:

Loan Refinance

According to the Union, one does not have to complete serving a particular loan before coming for another, after paying for some time, provided you get an available affordability you can still come and apply for refinance and recalculation will be done for you to take a new loan.

You can also come for another loan in a different category provided you have affordability. For instance, you can go for a Personal loan, and later go for a habitat loan as well provided you have the affordability.

CALL SEEKERS CONSULT 247 FOR A FAST LOAN 0550414552 FOR GOV. WORKERS

How to Apply for a GNAT Loan

Go to the Secretariat for a form, and Apply.

For emergency Loans

For Emergency Loans, go for the forms, Apply, and Prompt the Chairman or the secretary to fast-track it for you, especially if it is a medical emergency.

GNAT LOAN CHART

Obtain the Latest Loan Chart from here the teachers telegram Channel

Why Workers Opt for High-Interest Loans Over Union Loans

Many workers, despite the availability of potentially lower-interest union loans, often find themselves taking out loans with significantly higher interest rates from other financial institutions. Several factors contribute to this seemingly counterintuitive decision:

1. Cumbersome and Lengthy Application Processes:

The sheer amount of paperwork and bureaucratic hurdles associated with union loan applications can be a major deterrent. Workers needing funds urgently may find the prospect of lengthy forms, supporting documents, and multiple approvals overwhelming and time-consuming.

2. Loan Amount Limitations Based on Contributions:

Union loans are often tied to the amount a member has contributed and their duration of membership. Newly joined workers or those with relatively low accumulated contributions may not qualify for the loan amount they actually require, forcing them to seek alternative sources.

3. The Burden of Guarantorship:

A significant obstacle for many is the requirement for guarantors. Not all colleagues are willing or able to act as guarantors, fearing potential financial repercussions if the borrower defaults. This can leave many workers, especially newer or less established ones, without access to union loans.

4. Speed and Efficiency of Alternative Loans:

In stark contrast, other loan providers often boast significantly faster processing times. The promise of quick disbursement, sometimes within hours, is a powerful draw for individuals facing urgent financial needs. The provided contact number (0550414552) explicitly advertises “quick loans without guarantor,” highlighting this key advantage. Union loans, on the other hand, can reportedly take up to four months to be processed, rendering them impractical for immediate needs.

5. Lack of Processing Fees with Alternative Loans:

The absence of processing fees associated with some alternative loans can also make them appear more attractive upfront, even if the long-term interest costs are higher.

6. Privacy Concerns and Disclosure Requirements:

The need to obtain multiple signatures for union loan applications can necessitate explaining the purpose of the loan to various individuals. This lack of privacy and the need to disclose personal financial matters can make some workers uncomfortable and push them towards more discreet options.

In conclusion, while union loans may offer the potential for lower interest rates, the cumbersome processes, limitations based on contributions, the need for guarantors, and the slow processing times often outweigh this benefit for workers needing immediate and hassle-free access to funds. The allure of quick, unguaranteed loans, despite their higher interest costs, becomes a more appealing solution for their immediate financial needs.

Please with the habits and vehicle loans,how much is monthly deduction.