2024 How to cancel any insurance policy or wrong deductions and get your money back

How to cancel any insurance policy or wrong deductions and get your money back.

We all subscribe to life insurance for a purpose, whether it is to replace income, cover debts, send a child to school, Funeral, or for many other reasons.

For some reason, it makes sense to cancel a life insurance policy if the need has been satisfied, or there are major outstanding issues for which you need the money, like going to school yourself and you need the money as a top-up, children growing up, or paying off debt.

Regardless of your reason to cancel a life insurance policy, it is relatively easy to do. The process depends on the type of life insurance policy you have.

Life insurance options if you have financial struggles

Rising inflation, job loss, job stagnation, and other misfortunes are causing many to have financial struggles. With less money to go around, it could mean you can no longer afford your premiums. While canceling your life insurance policy may be the right choice, it is not the only option you have available if you are struggling financially.

Depending on the type of insurance policy you have and when you got it, these options may be a better solution than canceling your life insurance policy:

If you have a whole-life policy, and you have had it for at least a decade, you may have built up enough cash value in the policy to be able to use your dividend payments to pay your premiums.

Review

Checking if your health has improved since you purchased a life insurance policy, you can request a new medical exam to prove that you are in better shape and thus eligible for lower premiums.

If the person you have insured died, you can quickly exit the insurance.

This is a good option if you have quit smoking or no longer have a health issue that you had in the past.

Most of us leave it and continue to pay high premiums, but we can change our policies or review them from time to time.

Talk to your insurer about whether you can lower your rate of coverage. Some companies will allow you to reduce the amount of death benefit.

Cancel life insurance policy.

Canceling a Life Policy here sometimes is difficult, after filling out the forms to cancel, your pay slip comes and you continue to see deductions on it.

But Canceling a life insurance policy in the US is typically not hard. You have the right to cancel anytime during the free look period, which lasts anywhere from 10 to 30 days depending on what U.S. state you live in.

If you realize within that period that you have changed your mind about buying the policy, you can call or write to your insurer to cancel and any premiums you have paid will be fully refunded.

To cancel Fully your Insurance Package,

First, visit or call the insurance company to obtain a form to cancel and get back to read the policy on Cancelling insurance so that you can get your money or the percentage of your money Back.

If after canceling, you still see Deductions on your payslip or Your Account, Report immediately to the insurer.

Login to your payslip Portal and fill in the forms for Wrongful deductions and submit.

NIC

Visit any National Insurance Commission office NIC, and Report the canceled insurance that keeps deducting, you’ll be given forms to fill out, and you can go to the office with a copy of your Bank statement that shows the deductions.

After investigations by the NIC, the full policy will be canceled and your Funds will be refunded into your Account.

However, if you think you may need the death benefit in the future, there is an alternative that could be a better option.

Instead of surrendering the policy, you could use the cash value as collateral and take a policy loan. It keeps the death benefit intact but gives you the cash infusion you need now.

However, it’s worth noting that if the loan is not repaid, typically, the principal amount of the loan and any accrued interest is taken from the policy’s death benefit when the insured passes away and the beneficiary requests the proceeds from the policy.

Some insurers allow you to modify your policy so you keep some death benefits while paying a reduced premium or no premium at all, with all fees being paid by your equity in the account.

But beware: if you just stop making payments without an agreement in place with your insurer, the policy could lapse. So in this case, talk to your insurance agent to see what options are allowed by your policy.

Do you get money back when canceling life insurance?

The answer to this question is that it depends. If you have a term life insurance policy, which has no cash value component or investment option, the only possibility of getting money back is if you cancel in the middle of your payment cycle.

Then, you may receive a check for any premium that has not yet been applied to your account — which is going to be a very small amount compared to the policy’s death benefit.

If you have a permanent life policy, and you have equity built up in the policy because you have been paying into it for a decade or more, you may receive a lump sum payment from your insurer.

They will subtract any fees or outstanding loan balance from this payment and send you the rest of the cash value of your policy. This, too, will probably be far less than your death benefit.

You lose your premium payments

It’s important to know what the consequences are of canceling life insurance. When it comes to your premium payments, it depends on the life insurance. In most cases, your premium payments will be forfeited, and you will not receive anything for your previous payments.

The one exception to this is if you have whole life insurance and cancel it. You may have built up equity for all of the payments you have made so you may receive a lump sum payment from your insurer.

Keep in mind, if you cancel your whole life insurance in the first 10 or 20 years, you may have to pay surrender fees, which can greatly reduce the lump sum you get from the insurance company.

Summary

To cancel your insurance for a refund, speak to the insurance company to know the deal about canceling and refunds.

Visit National Insurance Commission with your documents for assistance to cancel for a full refund.

If you receive salary through the Controller and Accountant General’s Department, log in to the portal and fill in the form for wrongful deductions and submit it.

How to cancel any insurance policy or wrong deductions and get your money back

Courses under ( Insurance All Options) at the University of Ghana -UG

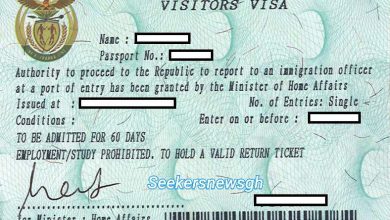

American National Insurance For all Travel to America Tourist