How to Calculate your Monthly Pension Pay on the SSNIT Calculator Portal in Ghana

How to Calculate Your Monthly Pension Pay on the SSNIT Calculator Portal

Wondering how much you will earn when you go on a pension?

Here is how to use the SSNIT Pension Calculator to Check how much you will get when you go on Pension.

According to the SSNIT Data, the least paid pension for 2024 is GHS 300 and the Highest is GHS 26,000 plus a Month.

So how come some earn about GHS 300 a Month and Others Earn Your26,000 a Month?

You can make the effort by knowing how much you’ll earn if you go on a pension now.

How to use the SSNIT Pension Calculator to Calculate your Pension

Go to your web browser

Search the SSNIT Pension Calculator

Pension Estimator

Or Go to the SSNIT Main website and Click on Self-Service

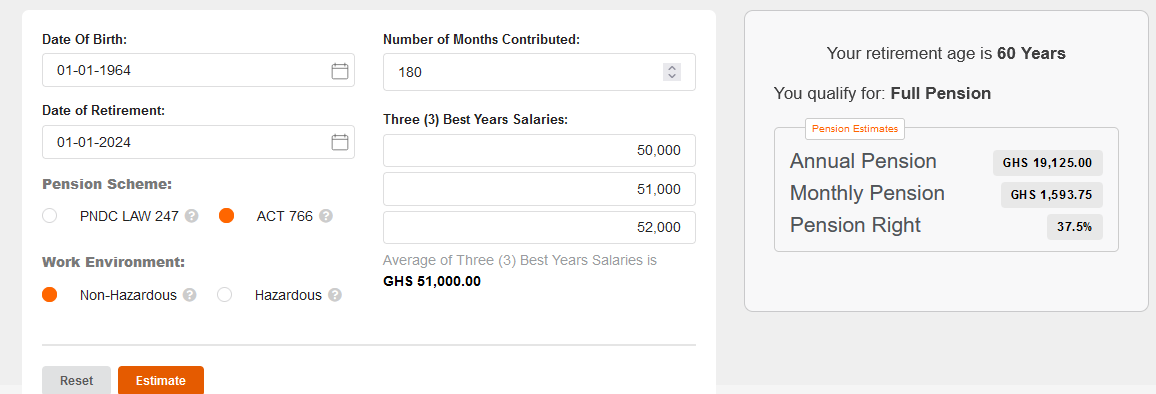

Please note: The results generated are estimates and not actual pension figures. Your actual benefits may be more or less and will depend on “The age you plan to retire;” “Your total number of contribution payments at retirement” and “Your three best years’ annual salaries.” The values of these factors can change over time.

You must be at least 55 years old and also meet the minimum required monthly contributions (I.e. 240 months for PNDCL 247 and 180 months for ACT 766) to estimate your benefits. You will need to be logged in to use your real contribution information to estimate your benefits.

Here is the Calculator, Click on it to Calculate. Video Guide below

PENSION ESTIMATOR PORTAL CLICK HERE

This estimator indicates you were earning around 4, 250

To qualify for an Old Age pension, the member must be at least 60 years old and must have contributed a minimum of 180 months (15 years) under Act 766 and 240 months (20 years) under PNDCL 247. The member who is 55 years old but below 60 years receives a reduced pension whilst the 60-year-old receives a full pension.

BASIS FOR CALCULATION OF OLD AGE PENSION

- Age

- Average of Best 36 months / 3 years’ Salary

- Earned Pension Right – Rating for the number of months you have contributed to the Scheme.

You can earn a “pension right” between 37.5% and 60% depending on the number of months contributed at the time of retirement. E.g. the minimum contribution of 180 months gives a “pension right” of 37.5%. Every additional month over the 180 months attracts an additional percentage of 0.09375% or 1.125% for

One (1) year respectively.

TO CALCULATE YOUR PENSION

Multiply your best 36 months (3 years) average salary by your “pension right”.

EARNED PENSION RIGHT UNDER THE NATIONAL PENSION ACT, 2008 ACT 766

The Pension Right is 2.5% for each year of contribution for the first 15 years and 1.125% for every additional year up to a maximum of 60.0%.

| Years of Contribution | 15 | 16 | 17 | 18 | 19 | 20 | 21 | 22 | 23 | 24 | 25 |

| Pension Right (%) | 37.50 | 38.63 | 39.75 | 40.88 | 42.00 | 43.13 | 44.25 | 45.38 | 46.50 | 47.63 | 48.75 |

| Years of Contribution | 26 | 27 | 28 | 29 | 30 | 31 | 32 | 33 | 34 | 35 | 36& above a |

| Pension Right (%) | 49.88 | 51.00 | 52.13 | 53.25 | 54.38 | 55.50 | 56.63 | 57.75 | 58.88 | 60.00 | 60.00 |

REDUCED PENSION – EARLY RETIREMENT

To qualify for Reduced Pension,

- You must be 55 years and above but below 60 years of age; and

- You must have made a minimum contribution of 180 months (15 years) under Act 766 and 240 months (20 years) under PNDCL 247.

EARLY RETIREMENT – AGE REDUCTION

For early retirement reduction with a factor from 55 years and below 60 years, the pension is computed as follows:

| AGE (Years) | 55 | 56 | 57 | 58 | 59 |

| % of Full Pension | 60% | 67.5% | 75% | 82.5% | 90% |

REFUND OF CONTRIBUTIONS

If you do not qualify for Old Age Pension when you retire either compulsorily or voluntarily; your contributions will be refunded to you with interest.

QUALIFYING CONDITIONS

- You must be between 55 and 60 years.

- Where you have not made the minimum aggregate contribution period of 180 months, you will be entitled to a lump sum payment of your total contributions with interest.

- Contact the nearest SSNIT Branch with your Smart Card or Biometric Card, letter of retirement from your employer—not mandatory.

- The SSNIT Branch will then provide you with a Pension Application Form for completion.

- Submit your completed Form to the SSNIT Branch.

- Provide an active bank account number that bears your name—evidence of bank account details.

- SSNIT will advise you to collect your monthly pension at your bank

Pensioners after attaining the age of 72 years for those under PNDCL 247 and 75 years for those under Act 766 would be required to go through the identification process yearly.

HOW LONG WILL PAYMENTS BE MADE?

You will receive your payments till death or when you recover and choose to continue contributing.

DEATH AND SURVIVORS LUMP SUM

Death and Survivors Lump sum is the benefit paid to nominated or eligible beneficiaries of a deceased contributor or pensioner. It can also be paid to persons upon an order by a court of competent jurisdiction. This benefit is paid when a member dies in active service or during retirement and has not attained the age of 72 years for those under PNDCL 247 and 75 years for those under the National Pensions Law, Act 766 respectively. The deceased member’s beneficiaries will be identified and all benefits due paid to the beneficiaries identified.

SURVIVOR’S LUMP SUM

This benefit is paid to dependants of members under the following conditions:

- When the member dies before retirement; or

- When a pensioner dies before attaining age 75.

CALCULATION OF SURVIVORS’ LUMP SUM

The benefit is computed as follows:

- Where a member dies having made at least twelve months of contributions within the last 36 months before the death of the member, a lump sum payment of the earned pension of the deceased member for 15 years will be paid. The amount will be the present value discounted and paid to the member’s nominated dependents.

- Where a member dies before making at least twelve months of contribution within the last 36 months, a lump sum equal to the total contributions and interest shall be paid to the nominated dependants.

- Where a pensioner dies before attaining age 75, a lump sum payment based on the present value of the unexpired pension of the member will be made to the beneficiaries.

HOW TO APPLY

- Report the death of the member to the nearest SSNIT Branch with any of the following:

Primary Evidence:

- Letter from the employer where available.

- Affidavit from Chief of the Village or Town.

- Police Report.

The following Secondary Evidence of death could be accepted in addition to the above-mentioned:

- Posters

- Burial Permit, etc.

- On receiving information about the death of a member, SSNIT will identify the nominated dependant(s) and request them to apply for the benefit.

- A dependant(s) may call at a SSNIT

Branch to collect, complete, and submit an Application Form with the following:

- The Membership Certificate of the deceased if available.

- Birth Certificate of minors if applicable

- A Bank Account Number that bears the dependant’s name – evidence of bank account details.

- A photo identity card.

SSNIT will process the application and a lump sum payment will be made into the account.